Patriotic Millionaires

➡️ PATRIOTIC MILLIONAIRES – I'm a Millionaire, Tax Me More!

Founded in 2010, Patriotic Millionaires is a nonpartisan organisation made up of wealthy individuals who advocate for economic justice and tax reform. There are two branches of the organisation, one in the U.S. and one in the UK, both of which now include hundreds of members.

High-profile supporters include Abigail Edna Disney, the heir to the Walt Disney fortune, city trader turned activist Gary Stevenson, former BlackRock managing director Morris Pearl, musician Brian Eno, investor Julia Davies, and screenwriter Richard Curtis.

Their mission is to address income inequality by fostering a fairer economic system. They lobby for policies such as corporate accountability, transparent campaign funding, and a living wage.

Jump straight to our resources on ➡️ Patriotic Millionaires

Explore our comprehensive guides on -

-

Tax Dodging & Tax Cuts for the Wealthy – U.S.A

-

Poverty vs Wealth: A Social Justice Issue

"Those with the most should be told to pay their fair share - just like millions of working people do everyday - to help get our country and the economy back on its feet. Seven in 10 UK millionaires support higher taxes on the super-rich and three-quarters of Brits agree with them" - Julia Davies.

*****

Tax the Rich UK

In the UK, the lowest 10% of earners have an effective tax rate of 44%, more than twice as high as that of those in the top 0.01%.

This is because income is taxed at a higher rate than wealth, meaning that those who gained their wealth through investments or rising property values (the majority of millionaires) pay a lower percentage of tax.

-

In 2022/23, more than 1 in 5 people in the UK were living in poverty – 14.3 million people.

-

The wealth of the richest 1% of households is greater than that of the entire bottom 80% of the population.

-

The covid-19 pandemic saw the number of billionaires in the UK increase by 20%.

Public support for a UK wealth tax is overwhelming, with 78% advocating for an annual wealth tax for those with assets worth over £10 million. Even just a 2% tax increase on those with assets over £10 million could raise £22 billion per year. This is enough to cover the average salary cost of more than 600,000 nurses a year.

Tax the Rich U.S.A

Just like the UK, the current U.S. tax system rewards wealth over work, thanks to a tax code that favours income from wealth. As a result, billionaires pay a smaller tax rate than ordinary working Americans.

The wealthiest 400 families in the U.S. pay an average tax rate of 8%, while the average American taxpayer pays 13%.

-

The official poverty rate in 2023 was 11% equating to 37 million people.

-

The top 10% of earners own 67% of total wealth in the U.S.

-

There are 748 billionaires living in the U.S. whose wealth increased by 88% in the last four years.

-

Musk, Zuckerberg and Bezos combined have more wealth than the entire bottom half of American society.

-

More than 60% of Americans live paycheck to paycheck.

-

There are 800,000 homeless people living on the streets.

-

The U.S. has the highest rate of childhood poverty among developed nations.

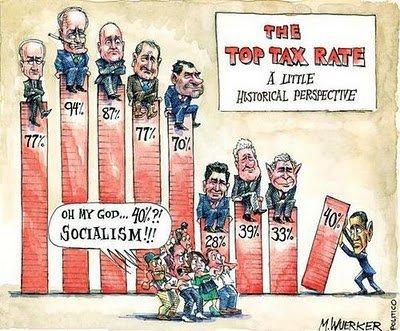

With this in mind, 64% of Americans support a wealth tax on the super-rich. Over the years, the progressivity of the U.S. tax policy has dramatically declined – in 1950, the super-rich paid around 70% of their income in taxes, by 2018, this figure had gradually been reduced to around 23%. To serve the interests of the super-rich, the U.S. tax system has become much more regressive.

In 2017, the U.S. government is estimated to have lost $135 billion to corporate tax loopholes and avoidance strategies. Of America's largest corporations, 55 paid no federal corporate income tax in 2021 in a decades-long trend of corporate tax avoidance.

The 2017 Trump tax law was so skewed towards the rich that it allowed tax cuts of $60,000 for those in the top 1%; meanwhile, those in the bottom 60% received an average tax cut of $500! A tax proposal by Biden, the Billionaire Minimum Income Tax, would have imposed a 25% tax on all wealth over $100 million and applied to only 0.01% of Americans, but it never made it through Congress.

What Reforms Progressive Millionaires Propose?

Through public advocacy, media appearances, and collaboration with lawmakers, Patriotic Millionaires work to shift public discourse and influence legislation. They aim to create a fairer economic system that benefits everyone, not just the privileged few, by addressing systemic inequalities and promoting policies that ensure economic opportunity and security for everyone.

Some of their priorities include -

-

Higher taxes on the wealthy, which ensure that the most affluent Americans pay their fair share.

-

Closing loopholes that allow tax avoidance and implementing a more progressive tax system overall.

-

End multinational corporation tax evasion and profit shifting to tax havens.

-

Properly tax income gained from wealth (investment income/inheritance).

-

A much higher taxation rate on private jets.

-

Paying people a fair living wage - Reduce poverty, boost consumer spending, and stimulate economic growth.

-

Campaign finance reform to limit the power of wealthy individuals and corporations in political decision-making. They seek greater transparency in party funding and to reduce the considerable influence that money has on elections and policy-making.

-

Introduce a gas and oil windfall tax.

-

Put an end to fossil fuel subsidies and redirect the money into public spending.

*****

The Patriotic Millionaires have successfully built a coalition of wealthy individuals who use their influence and resources to lobby for progressive economic policies. They serve as excellent role models for others and provide the platform for them to easily follow suit.

Their persistent advocacy for greater economic equality, even at their own expense, has raised public awareness of the serious economic disparities and the threat to democracy that big money poses. Let's continue to push for economic fairness and social justice for everyone.

Tax the rich. Pay the people. Spread the power!

Author: Rachael Mellor, 25.10.25 licensed under CC BY-SA 4.0

For further reading on Patriotic Millionaires see below ⬇️

- Patriotic Millionaires UK494802

- Instagram494816

- TikTok494837

- @PatrioticMills494803

- @PatMillsUK494804

- @PatMillsCanada494806

- Patriotic Millionaires - USA481115

- Patriotic Millionaires - Who we are495088

- YouTube Channel - USA481126

- LinkedIn - USA481117

- Patriotic Millionaires - USA481119

- LinkedIn - UK481116

- YouTube Search - Tax Me Now481123

- YouTube Search - Patriotic Millionaires481124

- Oxfam - Patriotic Millionaires494815

- Influence Watch - The Patriotic Millionaires 494817

- Tax Extreme Wealth - Signatures494836

- Millionaires for Humanity495085

- Wikipedia481114

- Erica_Payne (USA) - Wikipedia481120

- The Agenda Project - Wikipedia481121

- @CatHadleyA2 - Cat Hadley494807

- @AZBobLord - Robert Lord494805

- @abigaildisney - Abigal Disney494808

- @garyseconomics - Gary Stevenson494810

- Gary Stevenson (campaigner) - Wikipedia494849

- @Phil_White_99 - Phil White494813

- @MakeThem_Pay494812

- #ZucmanTax494809

- #TaxWealthNotWork494811

- Erica Payne - Wikipedia494846

- Erica Payne - LinkedIn494847

- Podcast: Strategist Erica Payne Is No Shrinking Violet - The Wakeman Agency494848

- Be Outraged Already: Your True Income Tax Rate May Triple the Rate the Richest U.S. Billionaires Pay - Patriotic Millionaires 05.12.25500694

- That’s a Wrap: Patriotic Millionaires’ 2025 Fall Member Summit - Patriotic Millionaires 25.11.25500695

- Patriotic Millionaires ramp up calls for the wealthiest to pay more tax - LFF 22.11.25499234

- Video: Abigail Disney: “There is such a thing as too much money — and it’s bad for everyone” - ICRICT 17.10.25495090

- Do the Patriotic Millionaires UK have more money than sense? - Wealth Net 04.08.25494824

- I support the mission of Patriotic Millionaires UK - Dan Aldridge MP 16.07.25494814

- Tax the titans! A 2% wealth tax on £10m+ fortunes to crush inequality - Dale Vince 11.07.25495105

- Podcast: Is it time for a wealth tax on the super-rich? - Guardian 10.07.25495108

- Video: ‘Millionaires are not leaving Britain, it’s a myth’ | LBC 08.07.25481125

- The Rich Should Be Paying More—and Yes, That Means Me - TNR 23.06.25495091

- Patriotic Millionaires member perfectly sums up why a wealth tax would be fair - We Have the Power 21.05.25494821

- The Independent: Why as a British millionaire, I believe rich people like me need to pay more - We have the Power 21.05.25494840

- Time for a wealth tax, say Patriotic Millionaires as Rich List shows £772bn in the hands of just 350 families - Independent 16.05.25494819

- These Canadian millionaires are asking for tax increases — but just for themselves - CBC 11.05.25481118

- Patriotic Millionaires Unveil Platform to ‘Beat the Broligarchs’ - CD 07.04.25494832

- Abigail Disney: ‘Every billionaire who can’t live on $999m is kind of a sociopath’ - Guardian 07.04.25495089

- Video: Millionaire Julia Davies spells out need for a wealth tax - Peeps 30.03.25494839

- ‘Trickle down theory doesn’t work – the rich just keep it all for themselves’ - Islington Tribunw 28.03.25495102

- Video: Brian Eno perfectly explains selfishness of the super rich. ..."If they want to leave the UK, then... f*** off" - Eat the Rich 25.03.25495100

- Video: More tax! Millionaire Dale Vince hates 'rich freeloaders' - Peeps 24.03.25495106

- ‘I’m worth millions – I should be taxed more’ - Telegraph 20.03.25494845

- More taxes? Yes please! Patriotic Millionaires want to do more for the country - Yorkshire Bylines 18.03.25494818

- Video: Gary Stevenson on taxing the rich and why you're getting poorer | WTCTW podcast - Channel4 05.03.25495084

- Wealth tax: Addressing inequality or hindering growth? - Dale Vince 29.01.25495107

- Tax the rich – do it now. Start with me - Guardian 23.01.25495103

- Brian Eno: It's time for a tax on the super rich - Rolling Stone 15.11.24495101

- 'We want a society that works for everyone': These millionaires want Rachel Reeves to tax them more - Big Issue 30.10.24494823

- Let’s see if ‘Patriotic Millionaires’ really want more tax - Spectator 17.10.24494826

- Labour's £5m donor Dale Vince pushes Reeves to hike corporation tax to 30 per cent - INews 15.10.24495110

- Video: Millionaire Dale Vince calls out rich fleeing the UK to avoid tax rises - PoliticsJOE 24.09.24495104

- Why is it so hard to tax the rich? Would it fix our economy? With Gary Stevenson - Crooked 11.06.24495086

- The life and activism of Abigail Disney, the millionaire heiress who wants to be taxed more and is critical of her family company - Business Insider 21.01.24495092

- UK millionaires group projects ‘tax our wealth’ on to Treasury and Bank of England - Guardian 21.11.23494829

- Billionaires Should Pay a Global Minimum Tax, Researchers Say - Bloomberg 22.10.23495095

- Meet the Patriotic Millionaires who want to pay more tax - The Times 02.07.23494830

- Meet The Patriotic Millionaires: The Rich People Who Want To Be Taxed More - Broke-Ass Stuart 27.06.23494827

- Good Law Project and Dale Vince take legal action to close the £600 million private equity tax loophole - Good Law Project 06.06.23495109

- Video: The Great Economy Project Online — The Big Picture with Erica Payne 6/23481127

- Meet Britain’s big brand millionaires calling for a wealth tax - The Telegraph 11.04.23495111

- We’re millionaires, why can’t we pay more tax? Meet the super-rich lobbying for change - Metro 06.03.23495087

- I’m a millionaire – this is why I’m at Davos begging to pay more tax - Guardian 19.01.23494820

- Chuck Collins, the activist who gave up his inheritance: ‘The United States is now one of the biggest tax havens’ - El Pais 19.01.23495096

- Meet Abigail Disney, the multimillionaire ‘class traitor’: Walt Disney’s grandniece and heiress wants to tax the rich more and has called billionaires ‘miserable, unhappy peo…495093

- “Patriotic Millionaires” in the U.K. call for higher taxes … on themselves - Marketplace 05.04.22494828

- The millionaires and billionaires who want to pay more tax - Love money 19.01.22495098

- The worst part of Trump paying zero taxes? It's probably entirely legal - Guardian 02.10.20495097

- "Please tax us": 83 millionaires demand higher taxes to fund coronavirus aid - The Better 13.07.20495099

- Sidebar: Millionaire Patriots - Reflections, 2020494822

- America needs to seriously tax the rich – I should know, I'm one of them - Guardian 06.11.19495094

- Patriotic millionaire: Don't just tax the rich, tax more of them - Fox Business 16.05.19494838

- The Patriotic Millionaires aren't even trying now - Adam Smith Institute 494831

- Marlene Enghelhorn (Austria)481122