Gary Stevenson (UK)

➡️ GARY STEVENSON – Outspoken Economist on Reducing Inequalities & Taxing the Rich

Stevenson is a former financial trader turned inequality economist after banking millions and realising just how rigged the system is against the poor.

Coming from poverty himself, he became Citibank's youngest ever trader. He rose to success after betting that "inequality was going to destroy our economy and make the poorest in society even poorer".

He predicted the continued collapse of the economy and earned millions because of it. This just did not sit right, and so he turned his attention to activism and advocacy against the system that makes the rich richer and the poor poorer – inequality.

His work involves raising awareness across various media channels. His YouTube channel and podcast 'Gary's Economics' have amassed 1.5 million subscribers each. In 2024, he released his first book, 'The Trading Game', which is now a number 1 Sunday Times best seller and is up for various awards.

Gary also campaigns for Millionaires for Humanity and is a founding member of Patriotic Millionaires UK. Both of these groups are networks of high-net-worth individuals who support wealth taxes on multimillionaires to reduce inequality and advance the Sustainable Development Goals.

Jump straight to our resources on ➡️ Gary Stevenson

Explore our comprehensive guides on -

-

Guide to the Economy & Key Issues in the Global Financial System

-

Capitalist Economy – Key Issues

-

Key Players in the Global Economy

To summarise the phenomenon of how wealth concentration prevents the poor from becoming wealthier - "The rich get the assets, the poor get the debt, and then the poor have to pay their whole salary to the rich every year just to live in a house. The rich use that money to buy the rest of the assets from the middle class, and then the problem gets worse every year. The middle class disappears, spending power disappears permanently from the economy," - Gary Stevenson.

*****

Inequalities in the UK

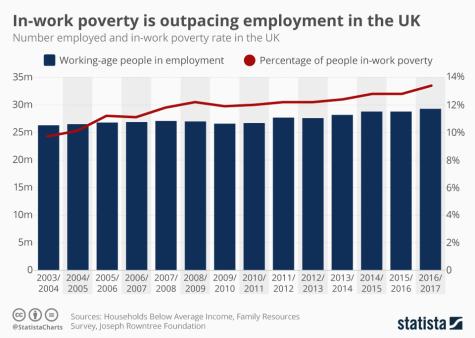

Economic inequality in the UK is at an all-time high and has been increasing year on year since the 1980s.

-

More than a decade of austerity by Conservative-led governments has resulted in £500 billion in lost public spending and a weaker economy.

-

In the tax year 2022/23, it is estimated that £5.5 billion was lost to tax evasion.

-

At current rates, nearly five million households will live in unaffordable homes by 2030.

-

Private renters spend around 42% of their income on rent; this figure rises to 72% in London.

-

In 2022/23, more than 1 in 5 people in the UK were living in poverty – 14.3 million people.

-

The wealth of the richest 1% of households is greater than that of the entire bottom 80% of the population.

Tax the Rich

Gary's unique perspective from both sides has allowed him to see how extreme concentration of wealth harms economic stability and social cohesion. He proposes imposing a wealth tax on the rich to restore imbalances and promote a fairer financial system.

"Tax work less. Tax wealth more." - Gary Stevenson

The majority of UK millionaires and billionaires actually pay lower rates of tax than ordinary working people, such as teachers and nurses. This is because income is taxed at a higher rate than wealth, meaning that those who gained their wealth through investments or rising property values (the majority of millionaires) pay a lower percentage of tax.

Currently, the lowest 10% of earners have an effective tax rate of 44%, more than twice that of the top 0.01%. Even just a 2% tax increase on those with assets over £10 million could raise £22 billion per year. This is enough to cover the average salary cost of more than 600,000 nurses a year.

By taxing the wealthy, the government could generate revenue to fund essential public services such as healthcare, education, and social security. These services especially benefit lower-income households at minimal cost to those on much higher incomes.

Public support for a UK wealth tax is overwhelming, with 78% advocating for an annual wealth tax for those with assets worth over £10 million.

An estimated £570 billion is thought to be held in offshore tax havens by UK residents, and £35 billion in tax revenue is lost every year due to tax evasion through fraud and underreporting of income.

The combined wealth of Britain's billionaires in 2022 was £653 billion. There is plenty of money, it just needs to be fairly taxed, and then invested back into the public.

Patriotic Millionaires

Founded in 2010, Patriotic Millionaires is a nonpartisan organisation made up of wealthy individuals who advocate for economic justice and tax reform. There are two branches of the organisation, one in the U.S. and one in the UK, both of which now include hundreds of members.

Their mission is to address income inequality by fostering a fairer economic system. They lobby for policies such as corporate accountability, transparent campaign funding, and a living wage.

Through public advocacy, media appearances, and collaboration with lawmakers, Patriotic Millionaires work to shift public discourse and influence legislation. They aim to create a fairer economic system that benefits everyone, not just the privileged few, by addressing systemic inequalities and promoting policies that ensure economic opportunity and security for everyone.

Some of their priorities include -

-

Higher taxes on the wealthy, which ensure that the most affluent pay their fair share.

-

Closing loopholes that allow tax avoidance and implementing a more progressive tax system overall.

-

End multinational corporation tax evasion and profit shifting to tax havens.

-

Properly tax income gained from wealth (investment income/inheritance).

-

A much higher taxation rate on private jets.

-

Paying people a fair living wage - Reduce poverty, boost consumer spending, and stimulate economic growth.

-

Campaign finance reform to limit the power of wealthy individuals and corporations in political decision-making. They seek greater transparency in party funding and to reduce the considerable influence that money has on elections and policy-making.

-

Introduce a gas and oil windfall tax.

-

Put an end to fossil fuel subsidies and redirect the money into public spending.

The Patriotic Millionaires' persistent advocacy for greater economic equality, even at their own expense, has raised public awareness of the severe economic disparities and the threat to democracy that big money poses. Let's continue to push for economic fairness and social justice for everyone.

Tax the super rich. Pay the people. Spread the power!

Author: Rachael Mellor, 10.12.25 licensed under CC BY-SA 4.0

For further reading on Gary Stevenson see below ⬇️

- YouTube Channel - GarysEconomics480970

- YouTube Channel - @garyseconomics - Videos480957

- Spotify - Gary's Economics499013

- Instagram499008

- Twitter / X480969

- TikTok499010

- Guardian499027

- Open Democracy499032

- #GarysEconomics481108

- Gary Stevenson (economist) - Wikipedia480954

- Patriotic Millionaires ramp up calls for the wealthiest to pay more tax - LFF 22.11.25499040

- Millionaires tell Rachel Reeves: Tax us more or lose to Reform in the next election - Big Issue 21.11.25499021

- Press release: leading organisations call for wealth taxes at the Budget - Tax Justice 19.11.25499020

- Video: Gary Stevenson: 'They own your country' | 30 with Guyon Espiner S4 Ep3 - RNZ 18.11.25499042

- Video: The Coming British Class War - Gary Stevenson - Jimmy the Giant 27.10.25499043

- Video: "We HAVE to be united." | Gary Stevenson on net zero, the NHS & taxing the rich (part 4) - How To Academy 25.10.25501810

- Video: How Labour Sold Their Souls To Billionaires | Gary Stevenson | Zack Polanski - Bold Politics 01.10.25499046

- Video: Economist fact-checks Gary’s Economics - Money & Macro 15.09.25499044

- Gary Stevenson and the failure of the left - Tax Research 11.09.25499031

- Gary Stevenson explains transformation from trading desk millionaire to inequality crusader - ABC 04.09.25499014

- My concerns about Gary Stevenson’s economics of wealth - Tax Research 07.08.25499011

- Video: Gary Stevenson: The Poorest People Are The Most Generous - Mad Sad Bad 22.07.25499047

- Video: Gary Stevenson: What I'd do if I was Chancellor - LBC 21.07.25499015

- Video: I'm back. This is how we fix the UK - Gary's Economics 13.07.25499045

- Book review: “The Trading Game” by Gary Stevenson (2024) - IEA 07.07.25499009

- Gary Stevenson reveals what he'd do if he was Rachel Reeves - LBC 21.07.25483451

- Gary Stevenson wants to save men from the Andrew Tate crowd - GQ 17.06.25499025

- What Gary Stevenson gets right and wrong - Socialist Worker 25.05.25499019

- The future of money with Gary Stevenson - iai Player 19.05.25499017

- Video: 10 Questions on Inequality with Gary Stevenson | Human Act Talks. @garyseconomics 5/25480955

- Video: Gary Stevenson tells James O'Brien why the UK economy is 'broken' - LBC 15.04.25499018

- Video: Trade War Chaos Drives Massive Volatility — ft. Gary Stevenson - The Prof G Pod 10.04.25499048

- Gary Stevenson is wrong about the real world - The Critic 08.04.25499028

- Who’s afraid of Gary Stevenson? - New Statesman 03.04.25499012

- Video: Why the Economy is Broken & Rich People Run Off to Dubai | Gary Stevenson - High Performance 01.04.25499037

- Video: Why Labour is crushing your living standards - Gary's Economics 30.03.25499036

- Truth about Gary Stevenson: Rags-to-riches city trader turned left-wing firebrand is accused of telling 'outlandish fibs' - Daily Mail 29.03.25499041

- Gary Stevenson is a new voice for old ideas - The Critic 26.03.25499016

- Does Gary Stevenson understand economics? - UnHerd 24.03.25 499029

- Video: Labour want to come on Gary’s Economics, should I let them? - @garyseconomics 23.03.25481112

- Gary Stevenson, the former trader taking on the billionaire class - Dazed Digital 07.03.25499026

- Video: Gary Stevenson on taxing the rich and why you're getting poorer | WTCTW podcast - Channel 4 News 05.03.25481113

- Book: The Trading Game 2/25480953

- Morning Coffee: Citi trader who retired aged 27 still makes "hundreds of thousands" trading. The only people allowed to work from home - efinancial Careers 27.01.25499035

- Video: Everything They Tell You About the Economy is WRONG | Aaron Meets Gary Stevenson - Novara Media 26.01.25499030

- ‘I was a multimillionaire, I had a beautiful girlfriend, I was unhappy’: the ups and downs of a supertrader - Guardian 1/25480956

- Gary Stevenson claims to have been the best trader in the world. His old colleagues disagree - FT 11.09.24499023

- Video: How to live in a collapsing economy - Gary's Economics 18.08.24499038

- Is Gary Stevenson really an economic guru? Meet the left-wing former trader - This is Money 20.05.24499034

- Game Theory and Gary’s Economics - Medium 19.03.24499033

- Gary Stevenson, City trader turned campaigner: ‘I made money betting on a disaster’ - Guardian 02.07.22499022

- Google News481111

- Google Images481110

- Google Scholar481109