Millionaires for Humanity

➡️ MILLIONAIRES FOR HUMANITY – Advocating for a Global Wealth Tax

Millionaires for Humanity (MFH) was launched in 2020 by Danish-Iranian civil society activist Djaffar Shalchi. MFH was established under the Human Act Foundation, a broader organisation that focuses on raising awareness of the vast inequalities in the world.

The initiative is supported by high-profile individuals such as Disney heiress Abigail Disney, Civic Ventures founder Nick Hanauer, and Austrian heiress Marlene Engelhorn. The members collectively call on the world's wealthiest to contribute at least 1% of their wealth annually to help support the Sustainable Development Goals. They 'recognise the need to go beyond philanthropy' to tackle global challenges such as poverty, climate change, and inequality.

"The need to tax rich people like me has never been so dire", and "It is only right that the funds to mitigate further damage and develop green energy systems come from those most able to pay" - Abigail Disney

Jump straight to our resources on ➡️ Millionaires for Humanity

Explore our comprehensive guides on -

- Economic Inequality

- Sustainable Development Goals (SDGs)

- Tax the Rich – UK & U.S.A

- Tax Dodging & Tax Avoidance by the Wealthy - UK

- Tax Dodging & Tax Cuts for the Wealthy – U.S.A

- Poverty vs Wealth: A Social Justice Issue

- Patriotic Millionaires

- Gary Stevenson

*****

Why We Need a Wealth Tax - According to MFH

"We recognise that while wealth can be a tool for positive change, it also comes with a responsibility to address the disparities it creates" - Millionaires for Humanity

The Covid-19 pandemic highlighted the urgent need to address intensifying economic inequalities around the world. The pandemic saw the wealth of the world's ten richest men double to a staggering $1.5 trillion. Meanwhile, 99% of Humanity watched their incomes fall.

"If these ten men were to lose 99.999 per cent of their wealth tomorrow, they would still be richer than 99 per cent of all the people on this planet," - Gabriela Bucher, Executive Director of Oxfam International.

The pandemic was great for the world's elite as, in an effort to save the economy, banks funnelled trillions of dollars into financial markets, boosting stock markets and the pockets of investors. As a result, the world's billionaires now have wealth roughly equal to the size of the Chinese economy.

New figures from the 2025 World Equality report reveal how the gap between the rich and poor continues to grow. The top 0.001%, around 60,000 multimillionaires, now hold three times more wealth than the poorest half of the world's population combined. As corporate profits and billionaire wealth balloon, everyday families struggle to pay bills, feed their families, and cover medical costs.

Inequality is now rising for more than 70% of the global population. This is a huge concern as divisions widen, economies fail, and social funding becomes an afterthought. A wealth tax is in everyone's interest, as inequality slows growth even further. Low health and educational outcomes then trap these people in a cycle of poverty in a system which is rigged against the poor and lasts generations.

Inequalities of this scale are not happening by chance. The financial system works in favour of the wealthy. Since Covid-19 exposed the greed, exploitation, and corruption at play by the 1%, fair taxation has taken on a new urgency.

Many tax systems reward wealth over work thanks to tax codes which favour income from wealth. As a result, billionaires pay a smaller tax rate than ordinary working Americans. In the U.S., the wealthiest 400 families pay an average tax rate of 8%, while the average American taxpayer pays 13%.

Although Federal taxes are considered progressive, they still only tax income. The vast majority of billionaires' wealth is not paid in income; it is in the form of stocks, shares, and investments.

MFH also highlights the risks of political influence from the wealthy elite. Extreme wealth in politics undermines democratic processes and results in policies that serve the few and not the many. In the 2024 presidential elections, U.S. billionaires spent nearly $2 billion on predominantly Republican campaign funding.

Vast wealth inequalities also result in serious and widespread climate injustices. The elite 1% are responsible for more than twice as many carbon emissions as the poorest 50%. Those on the frontline of climate change contribute the least to it and are the ones who suffer its consequences most severely.

What Would a Wealth Tax Achieve

A report by the Fight Inequality Alliance, the Institute for Policy Studies, Oxfam and the Patriotic Millionaires found that a wealth tax of just 2% annually for millionaires and 5% annually for billionaires would generate $2.52 trillion every single year. This is a staggering amount which would prove life-changing for billions. It is enough to lift 2.3 billion out of poverty, vaccinate all of the world's children, and provide universal healthcare and social protections for all citizens in low-income countries.

The objectives and benefits of a wealth tax include:

- Reduce inequalities – Through a redistribution of assets.

-

Improved public services – Stable funding would support healthcare, pandemic response, education, social security, and sustainable development.

-

Restore trust in tax and financial systems – Everyone contributes and benefits from the common good.

-

Promote economic stability – Increased capital in the economy,

-

Help to tackle climate change – Funding for a just green transition, and support for adaptation and mitigation measures such as conservation, reforestation, and renewable energy.

*****

Millionaires for Humanity work tirelessly to raise awareness of the consequences of wealth inequality and the potential of a wealth tax to address many of society's issues.

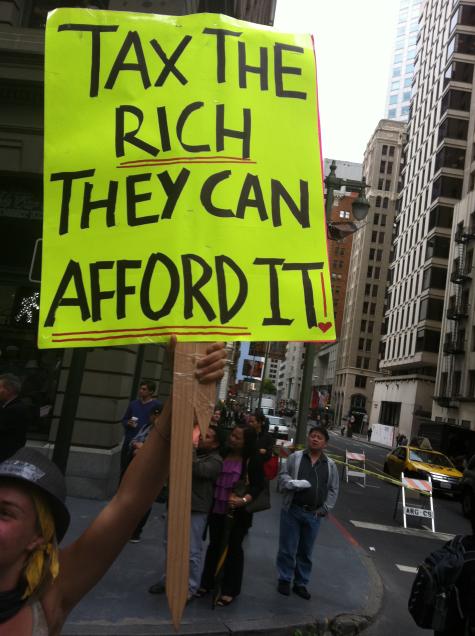

Their network provides the wealthy with a platform to unite, demand change, and use their money and influence for good. Together, their voices and impact are amplified. Common strategies include letters, petitions, and public demonstrations to push politicians to support a wealth tax.

Their use of the blue elephant in their campaigning symbolises the massively ignored issue of billionaire wealth. Their mascot stands for resilience, strength, and wisdom in a world where injustice, greed, and dishonesty run rampant.

These millionaires taking action for a fairer world believe that a wealth tax is a moral imperative. Never before has there been such a pressing need for systematic change and social justice.

Millionaires for Humanity - "Please tax us!"

Author: Rachael Mellor, 22.12.25 licensed under CC BY-SA 4.0

For further reading on Millionaires for Humanity see below ⬇️

- Millionaires for Humanity501182

- Millionaires for Humanity - Djaffar Shalchi501197

- Human Act501228

- Wikipedia501226

- Instagram501184

- About Human Act501227

- LinkedIn - Djaffar Shalchi502159

- Instagram - Djaffar Shalchi501198

- Millionaires for Humanity - YouTube501187

- Millionaires for Humanity - Wikipedia501183

- Millionaires for Humanity Calls Forbes List 'A Slap in the Face of Society' - CD 05.04.25501192

- Over 100 millionaires call for wealth taxes on the richest to raise revenue that could lift billions out of poverty - Oxfam 19.01.22501188

- You pay a higher percentage of your net worth in taxes than most billionaires do. This Danish millionaire wants that to change - Business Insider 12.06.21501199

- Millionaires for Humanity Petition: Who does not want to sign - Modern Diplomacy 04.08.20501189

- Never fear, Millionaires for Humanity are here - FT 15.07.20501186

- 83 of the World's 'Super-Rich' Call for Higher Taxes on ‘People Like Us’ to Help COVID-19 Recovery - Global Citizen 13.07.20501193

- Meet the millionaires who want to be taxed to pay for the coronavirus - Fortune 13.01.20501191