Meat Tax

Explore the environmental and health impacts of a meat tax, its benefits, and the consequences for farmers, livestock, the economy, and low-income families.

➡️ SHOULD WE START TAXING MEAT?

A Golden Egg for Climate or a Rotten Deal for Farmers & Families?

The concept of a tax on meat products, which places a levy on high-emission animal products, is gaining traction in the offices of agricultural ministries around the world. Spain and Switzerland have carbon pricing plans in place, and Denmark, a major producer of pork and dairy, will begin taxing livestock carbon emissions in 2030. New Zealand, Germany, and the Netherlands are in discussions.

The benefits are two-fold. Taxing livestock emissions according to their environmental impact will encourage consumers to make more sustainable choices. This reduction in demand will cut greenhouse gas emissions, which contribute to the climate crisis, and benefit public health as diets shift to more plant-based and less processed meals.

Taxing meat is heavily advocated by animal welfare and environmental groups alike, who argue that a sin tax, like those placed on sugar and tobacco products, has proven successful in changing consumer behaviour and mitigating their harmful effects.

Jump straight to our resources on ➡️ Meat Tax

Explore our comprehensive guides on -

-

Ultra Processed Foods (UPF)

How Bad is the Meat Industry?

-

Meat accounts for nearly 60% of all greenhouse gases from food production.

-

The meat and dairy industries are responsible for 14.5% of global greenhouse gas emissions.

-

Beef production is responsible for 41% of global deforestation, primarily in the extremely fragile Amazon rainforest region.

-

Globally, two out of three farm animals are now factory-farmed. Animals are crammed in their thousands into filthy, windowless cages, crates, or pens under highly restrictive conditions. They will not see the light of day and endure painful, miserable conditions every day until they are transported in equally unbearable units to the slaughterhouse.

-

Confining animals in mass in one place produces an over-saturation of waste, which the surrounding area cannot support. Factory farms are environmental hazards which pollute water sources, soils, and the air. Exposure to which causes respiratory problems, skin infections, nausea, and even depression.

-

An estimated 80 billion animals are slaughtered each year for food (not including fish).

-

Overuse of antibiotics in farmed animals contributes to antibiotic resistance in humans. Around 70% of global antibiotic use is in healthy farmed animals, which do not need this routine treatment. They are used to prevent infections and have a marginal effect on increasing growth rates.

-

High meat consumption, particularly processed and red meat, is associated with increased risks of heart disease, strokes, cancer, and diabetes. Vegetarians have a 14% lower cancer risk than meat-eaters.

-

If everyone in the UK ate meat-free lunches on weekdays, the NHS would save as much as £2.2 billion every year in reduced healthcare costs.

Could a Meat Tax do More Harm than Good?

As with any new, unexplored policy, the far-reaching implications must be fully understood, especially in this situation where animal welfare is at stake, not to mention the potential economic losses to farmers, the resulting job losses, and the impact on low-income families.

Another consideration is that when the price of red meat increases, rather than cutting down on meat in general, consumers may simply switch to other, lower-cost options, such as chicken. Chickens tend to be farmed in conditions much more harmful to their welfare than sheep and cows. If people start eating even more chicken, these animals may bear the brunt of a meat tax in a phenomenon known as the small animal replacement problem (SARP).

Depending on the implementation, a meat tax could further reduce conditions and treatment of livestock in general, as farmers are squeezed to the brink and forced to make further cutbacks.

A decrease in demand for meat would force many farmers out of business, lead to job losses throughout the supply chain, and affect rural economies. One report from the UK states that a meat tax would result in £100 million in annual savings from reduced emissions, but would cost the economy £242 million a year.

Fair Carbon Pricing on Food

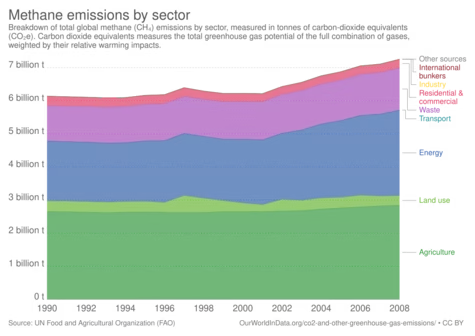

Paying for the environmental and health costs of meat production and consumption makes sense. Meat consumption has almost doubled since the 1960's and many countries are now eating way beyond the meat required in our daily nutritional needs. In some North American, European, and Latin American countries, red meat is being consumed at rates 300-600% higher than recommended.

It is already agreed upon by experts that we simply cannot meet our climate goals and protect our precious ecosystems without reducing our consumption of meat and making the industry more sustainable. A blanket meat tax may not be the answer, but rather a more tailored approach. For example, taxing products according to their environmental impact to reflect the damage that they cause.

Public attitudes towards a meat tax are largely negative. Support, however, increases when the tax covers all environmentally damaging foods, not just meat, and is coupled with subsidies on healthy foods, such as fruits and vegetables. If meat and dairy products are to become more expensive, healthy and sustainable options must become more affordable. There is also much more support if the revenue raised is used directly to improve the welfare of animals.

It is estimated that a 30% tax on meat and a 10% subsidy for vegetables would benefit the economy by more than €10 billion over thirty years. The success of a sin tax on meat will depend on how the revenue is used. One option is to give the money directly to farmers to cover the costs of their land stewardship, restoration projects, and the transition to producing high-quality, organic meat from much lower-density herds.

The money could also be used to support sustainable agriculture in general, fund educational campaigns about the benefits of plant-based diets, and help prop up the healthcare systems, which are struggling under the weight of unprecedented levels of cardiovascular diseases, diabetes, and obesity. We must also ensure that such a tax does not disproportionately affect lower-income families.

The True Animal Protein Price Coalition (TAPP) is a non-profit foundation that campaigns for fair prices and taxes to make the production and consumption of meat and dairy more sustainable and reduce the consumption of meat in line with planetary boundaries and dietary guidelines.

"The idea of a meat tax is not to punish consumers but to provide the right incentives for healthier and more sustainable eating habits." - Dr Richard Carmona, Former U.S. Surgeon General.

Author: Rachael Mellor, 08.11.25 licensed under CC BY-SA 4.0

For further reading on Meat Taxes see below ⬇️

- #MeatTax 495657

- True Animal Protein Price Coalition - TAPP 495485

- True Pricing of food - TAPP 495488

- EU Policy Proposals - TAPP 495490

- TAPP - Reports 495489

- TAPPC - Increasing number of countries start taxing meat and dairy 495682

- Food & Climate Action Group 495487

- Meat Tax - Wikipedia 495486

- Google News - Meat Tax 497031

- YouTube Search - Meat Tax 497032

- Google Scholar - Meat Taxes 497033

- UK 'meat tax' would cost economy almost £250m a year - Rothamsted Research 495644

- Just how effective would a European meat tax be for the environment? - Anthropocene 30.01.26 508781

- Brazil tries to sell skeptics on ‘low-carbon beef’ campaign at COP30 - Politico 14.11.25 498048

- A shift in food taxes could cut emissions and make diets healthier, researchers say - Euro News 24.10.25 495813

- Food tax shift could have both environmental and human health benefits - News Medical 24.10.25 495699

- Scandal-ridden telco Optus, the world’s biggest meat producer, global tech firms and huge gas producers are among a host of major companies earning billions of dollars a year… 495656

- Meat Taxes Are Super Risky. Maybe We Can Make Them Work - Effective Altruism 13.08.25 495675

- Understanding opposition: arguments for and against a meat tax in Sweden and their effect on policy attitudes - IOP Science 07.08.25 495698

- How JBS — the World’s Largest Meat Company — Avoids Paying Taxes - Sentient Climate 16.07.25 497035

- ‘Insanely tasty green food’: how the meaty Danes embraced a world-first plant-based plan - Guardian 31.01.25 495678

- Oxford VAT Study: Meat Taxes Could Benefit Public Health, Climate & Economy - Green Queen 30.01.25 495652

- Meat taxes are inevitable, yet we seem to shy away from them. But why? - Food Policy 1/25 497030

- Carbon Tax on Meat Could Generate €8.2B for Europe’s Largest Vegan Market - Green Queen 15.01.25 495684

- A reform of value-added taxes on foods can have health, environmental and economic benefits in Europe - Nature 09.01.25 495810

- Meat taxes are inevitable, yet we seem to shy away from them. But why? - Science Direct 01/25 495647

- Taxing Farm Animals’ Farts and Burps? Denmark Gives It a Try - NY Times 26.11.24 495672

- Denmark confirms details of new meat tax - BMPA 22.11.24 495664

- Flatulence tax: Denmark agrees deal for livestock emissions levy - BBC 18.11.24 495666

- The Danish carbon tax for agriculture is no carbon tax at all - Resilience 08.11.24 495677

- Worldbank: rich countries prioritise diet shifts away from meat; tax meat - TAPPC 21.10.24 495815

- Public preferences for meat tax attributes in The Netherlands: A discrete choice experiment - Science Direct 10/24 495683

- Meat tax must flow into more animal welfare without exception - Tierschutz Bund 02.07.24 495695

- Belching livestock to incur green levy in Denmark from 2030 - Guardian 26.06.24 495665

- Denmark will be first to impose CO2 tax on farms, government says - Reuters 25.06.24 495667

- Tax red meat to save the planet, Labour ‘megadonor’ urges - Telegraph 23.05.24 495655

- Effects of red meat taxes and warning labels on food groups selected in a randomized controlled trial - IJBNPA 15.04.24 495653

- While many of us have considered meat-free options this January, Dr Sanchayan Banerjee invites us to consider a #MeatTax, and how this could work to reduce the impact of its … 495663

- A meat tax can be environmentally friendly without affecting the poor - ZME 28.12.23 495693

- African countries urge rich countries to start GHG-emission food taxes - TAPPC 10.12.23 495816

- Meat tax: no UK politician is calling for one – but maybe they should - Conversation 06.10.23 495646

- Meat taxes in Europe can be designed to avoid overburdening low-income consumers - Nature 02.10.23 495649

- Farmers not 'out of woods' after PM rules out meat tax - BBC 23.09.23 495654

- Government's backpedalling on 'meat tax' is 'sleight of ham' - Vegetarian Society 21.09.23 495676

- Video: A tax to curb meat’s problems - FT Food Revolution 11.09.23 495822

- Impact of taxes and warning labels on red meat purchases among US consumers: A randomized controlled trial - NIH 09/23 495686

- Danish Climate Council Recommends Meat Tax & Replacing Two-Thirds of Meat With Plants - Vegconomist 02.03.23 495673

- Germans back a meat tax to improve animal welfare - Times 16.02.23 495697

- Animal welfare is a stronger determinant of public support for meat taxation than climate change mitigation in Germany - Nature 16.02.23 495679

- A meat tax is probably inevitable – here’s how it could work - Conversation 10.08.22 495696

- Why a meat tax is addressing the wrong problem - WEF 21.05.22 495688

- Meat tax: why chickens pay the price - Animal Ask 21.02.22 495817

- Taxing meat can protect the environment - Oxford Martin School 17.01.22 495685

- Report: Is Meat Too Cheap? Towards Optimal Meat Taxation - University of Oxford 01/22 495692

- Animals farmed: meat taxes, death in farming and anti-climate lobbying - Guardian 03.11.21 495818

- Should we tax meat to improve planetary health? A case study of values in the UK debate - Eye on Global Health 28.10.21 495820

- The great meat tax debate - CIWF 09.02.21 495690

- Analysis: How the Agribusiness Lobby Mobilised Against a UK Carbon Tax - DeSmog 05.02.21 495819

- A social cost-benefit analysis of meat taxation and a fruit and vegetables subsidy for a healthy and sustainable food consumption in the Netherlands - BMC 11.05.20 495691

- We put a “sin tax” on cigarettes and alcohol. Why not meat? - Vox 11.08.19 495687

- Climate change: German MPs want higher meat tax - BBC 08.08.19 495694

- The ESG risks and opportunity of a meat tax - FAIRR 14.05.19 495648

- 12 things you need to know about the meat tax debate - Food Navigator 16.11.18 495689

- We have no beef with the meat tax - Ecologist 16.11.18 495812

- Sixty seconds on . . . meat tax - BMJ 12.11.18 495811

- Meat tax: why taxing bacon could save thousands of lives every year - Oxford Martin 08.11.18 495809

- Taxing red meat would save many lives, research shows - Guardian 06.11.18 495650

- Why it’s time for a meat tax - New Statesman 17.09.18 495814

- Here Comes the Meat Tax - Atlantic 15.12.17 495821

- Meat tax ‘inevitable’ to beat climate and health crises, says report - Guardian 11.12.17 495704

- Toward a more consistent combined approach of reduction targets and climate policy regulations: The illustrative case of a meat tax in Denmark - Science Direct 10/17 495668

- Tax meat and dairy to cut emissions and save lives, study urges - Guardian 07.11.16 495680

- The rise and fall of the world's first fat tax - Science Direct 06/15 495681

- A swedish meat tax - Lund University, 2013 495702

- Report: Green consumption taxes on meat in Sweden - SLU 10/12 495703

- “Let’s Have a European Tax on Meat” - 4 Reasons Not to Be Fooled by this Simplistic Narrative! - FEFAC 495651

- This is why Denmark, Sweden and Germany are considering a meat tax - aPolitical 495674

- Googles Images - Meat Tax 497034