UN Framework Convention on International Tax Cooperation

➡️ UN FRAMEWORK ON INTERNATIONAL TAX COOPERATION – UN Tax Negotiations

To help close the vast gaps in existing tax systems and ensure countries receive fair tax revenues from corporations and the wealthy, the United Nations has created an Intergovernmental Negotiating Committee to finalise a new tax convention – the United Nations Framework Convention on International Tax Cooperation.

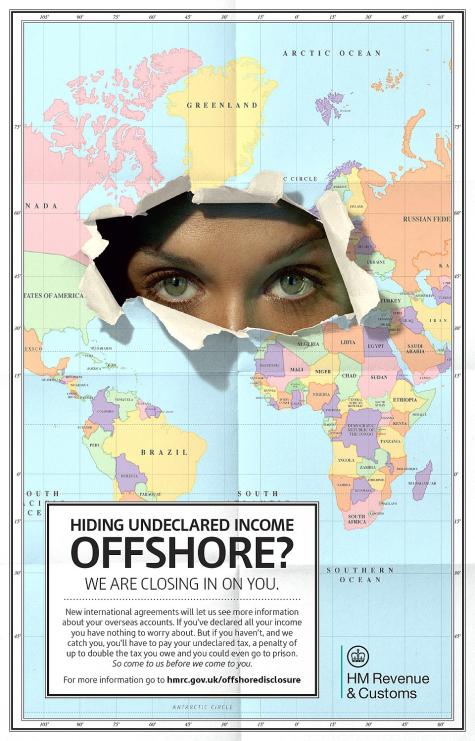

Improving global tax cooperation will involve greater transparency between countries, an expansion of assistance to collect tax debts, improved detection tools, and stricter enforcement of laws.

The third session was held November 10-19, 2025, in Nairobi, following on from two sessions in New York earlier in the year. Three more sessions will be held in 2026, and then the draft is set to be finalised in 2027.

“Governments now have a chance to choose differently at the UN, to choose to use tax to protect people, economies and planet” - Liz Nelson, Tax Justice Network

*****

Jump straight to our resources on ➡️ International Tax Cooperation

Explore our comprehensive guides on -

-

Tax Loopholes in the EU

-

The Panama Papers & the Paradise Papers

Tax justice and equality advocates are calling for a 25% minimum tax on multinational corporations and a tax on high-net-worth individuals worth over £100 million. Such large-scale sweeping reforms would be transformative, especially for developing nations struggling with high levels of debt, economic crises, vast inequalities, and high-level corruption.

International cooperation would include mutual administrative assistance, transparency, and information sharing, all of which would support the application and enforcement of new domestic taxation laws.

The historically slow pace of reform in the current international tax system is a result of consensus-based decision-making, which allows countries to block amendments when they do not serve their interests, much like the outdated Nato veto policy. More often than not, it is wealthy nations that stall progressive changes, a move which many African countries have objected to. They have been pushing for a majority voting system to promote faster and stronger action. After meeting in the middle, decisions at the conventions are now based on a two-thirds majority.

*****

Why We Urgently Need Global Tax Reforms

-

Countries lose $492 billion in tax revenue every year to tax havens, which multinational corporations and wealthy individuals use to underpay tax.

-

Nearly half of these losses are enabled by just eight countries - Australia, Canada, Israel, Japan, New Zealand, South Korea, the UK and the U.S.

-

OECD countries are responsible for 69% of global tax losses.

-

At current rates, we stand to lose nearly $5 trillion to tax havens in the next decade.

-

After tax cuts were made to multinational corporations to encourage them to pay their fair share, they were found to cheat the system even more. The theory of tax appeasement was disproved.

-

The gap between the rich and the poor continues to widen. Since 2015, the richest 1% have more wealth than the rest of the world combined.

-

Tax avoidance and evasion have reached unprecedented levels. These are not victimless crimes. Dramatically reduced tax revenues deprive citizens of vital services such as education and healthcare, as poor countries are forced to underinvest and make cutbacks.

-

Corporate tax dodging costs poor countries at least $100 billion every year.

-

Nine out of 10 of the world’s 200 richest companies have a presence in tax havens.

-

Europe’s 20 biggest banks register over a quarter of their profits in tax havens.

Proposed Solutions Under Discussion

-

Global minimum tax rate on high-net-worth individuals - These people often move their wealth to low-tax states. A blanket minimum tax rate would remove this privilege and ensure they pay their fair share. It will increase tax revenue for developing nations, improve global wealth distribution, and reduce inequalities.

-

Stronger tax enforcement - In particular for high-income individuals in low-income countries.

-

Detection - Developing more effective tools to detect tax avoidance and evasion schemes.

-

Transparency - A global system for sharing information on tracking assets, revenues, employees, reported income, and the structures used to avoid paying taxes.

-

Taxation of the digital economy - Operations with no physical presence must be taxed. Examples include online businesses, advertising revenue, the sale of data, and sales in app stores.

-

Tackling Illicit Financial Flows (IFFs) - Including corruption, tax evasion, and money laundering. IFFs need a clear legal definition, and a regulatory baseline must be established to target the enablers.

-

Environmental Taxation & Climate Financing - The ‘polluter pays’ principle taxes highly destructive industries, such as aviation, shipping, and fossil fuel production, based on their emissions and environmental impact. Developing countries can then use this revenue to help them recover from climate-related damage and fund climate adaptation.

*****

International taxation reforms are urgently needed to address great inequalities, human suffering, and irreparable damage to our planet. The revenue raised would be a serious boost to the Sustainable Development Goals, which are stalling in part due to a lack of financing.

Earlier in the year, the U.S. officially withdrew from negotiations, opposing more inclusive and effective international tax rules. They left the talks alone after attempting to rally others to join them. Under the leadership of Trump, this lack of cooperation is to be expected and may actually serve in the best interests of the new framework, as their vote can no longer be used to obstruct progress.

International cooperation is essential in the fight to close tax loopholes, stop tax havens, and promote equitable taxation for everyone. If delegates can pull it off, this will be the most significant reform in history to our global tax system and one of our best chances to level out inequalities.

Author: Rachael Mellor, 21.11.25 licensed under CC BY-SA 4.0

For further reading on the UN Framework Convention on International Tax Cooperation see below ⬇️

- Intergovernmental Negotiations for UN Framework Convention on International Tax Cooperation497156

- UN Framework Convention on International Tax Cooperation - Wikipedia497882

- Rethinking Tax Incentives for Climate Finance: Lessons for the 30th UN Climate Change Conference (COP 30) - IISD 12.11.25497907

- Nairobi Hosts Historic UN Tax Convention Negotiations - Science Africa 11.11.25497908

- Historic UN Tax Convention Negotiations Begin Text-Based Discussions in Nairobi - Policy Forum 11.11.25497909

- UN Tax Treaty talks key to unlocking trillions for climate finance and nature protection - Greenpeace 08.11.25497893

- The UN Tax Convention: the government’s chance to stand for economic justice - Bond 06.11.25497895

- UN Tax Convention Negotiations: Where are we at and where are we headed? - IDS 04.11.25497910

- From Lisbon: The Future Of International Tax Cooperation - Forbes 04.11.25497896

- Tax justice is workers’ justice: Why the UN tax convention matters for the world’s working people - ITUC 31.10.25497901

- Business takeaways from the first rounds of UN Tax Framework Convention negotiations - ICCWBO 20.08.25497890

- Progress on the Road to a UN Tax Treaty - HRW 20.08.25497898

- 5 reasons Greenpeace calls for new global tax rules at UN Tax Convention negotiations - Greenpeace 13.08.25497911

- UN tax talks could push polluters and billionaires to pay for harm to climate and nature - Greenpeace 04.08.25497904

- Trade unions call for ambitious tax justice reforms at UN negotiations - ITUC 04.08.25497897

- Report: A Roadmap for Negotiating the Protocols to the United Nations Framework Convention on Tax - IISD 16.07.25497894

- Next Steps for the UN Convention on Tax: Mapping Priorities - IISD 16.07.25497902

- How the UN Model Tax Treaty shapes the UN Tax Convention behind the scenes - Tax Justice Network 09.07.25497905

- UN urged to promote global tax cooperation to protect human rights - Jurist 26.06.25497906

- The collapse of international tax truce: Trump’s impact on digital taxation - ICTD 11.04.25497915

- Urgent call to action: UN Member States must step up with financial contributions to advance the UN Framework Convention on International Tax Cooperation - Tax Justice Networ…497900

- UN Convention on Tax: What happened at recent negotiations, and what’s next? - IISD 14.02.25497885

- Trump pulled the US out of global tax agreements and negotiations. It may backfire. - ICIJ 13.02.25497913

- United States walks out of UN Tax Convention process - Eurodad 04.02.25497912

- US scores own goal on day one of UN tax negotiations - Tax Justice Network 04.02.25497903

- Summary report, 3–6 February 2025 - IISD 497886

- As the U.S. Leaves the UN Tax Treaty Negotiations, Civil Society Calls on Countries to Continue Championing the Historic Process - Global Alliance for Tax Justice 04.02.25497914

- 5 reasons why the UK government should support the UN Tax Convention - Bond 30.01.25497899

- Sovereign Debt and Professional Enablers of Tax Abuse and Illicit Financial Flows - UNDP 13.01.25497888

- Taxing the Wealthy in Lower-Income Countries: Why It’s Important, and How to Do It - ICTD 01/25497889

- Tax cooperation policy brief - South Centre 19.12.24497887

- United Nations General Assembly votes overwhelmingly to begin historic, global tax overhaul - Tax Justice Network 27.11.24497891

- The UN Tax Convention and Why It Matters For Reforming Global Tax Governance - Tax Justice Network Africa, 2024497892

- A new UN Tax convention – how will it change global tax governance? - ICTD 01.12.23497883

- Global: Vote in favour of international cooperation on tax helps advance human rights - Amnesty 22.11.23497884