UK Budget - Critical Info

Critical analysis of the UK budget, tax changes, growth forecasts, borrowing, and the economic impacts on individuals and businesses.

➡️ UK BUDGET FOR 2026 - Autumn Statement 2025

In the run-up to the election, the Labour Party presented us with a fully costed manifesto and guaranteed that taxes would not rise for 'working people'. Once in power, they discovered a "£22 billion black hole" which they filled with public funds.

They then struggled to define what a 'working person' is, whilst Prime Minister Sir Keir Starmer warned that things would get worse. The autumn budget revealed just how much.

Tax rises of £40 billion were announced, the equivalent of £1,400 per household - the second biggest tax hike on record.

Jump straight to our resources on the ➡️ UK Budget

Explore our comprehensive guides on -

-

Politics in Britain

-

Economic Inequality in the UK

-

Budget Cuts & Austerity Programmes

-

Protests & Campaigns Against the Cuts

-

Increasing Militarisation

*****

Based on the October 2024 Budget and the 2025 Spending Review, Rachel Reeves has significantly altered spending plans from those inherited from the previous administration. The forecasts take us to 2028/29 and show that spending is up by £99.3 billion, taxes are up by £56 billion, and borrowing is up by £43 billion.

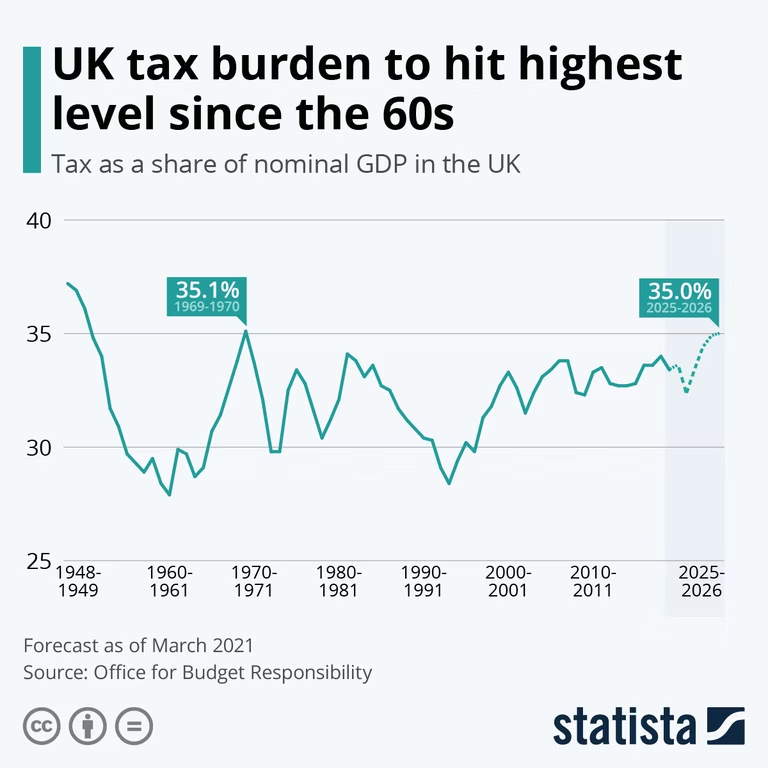

These increases are 10 times what was promised pre-election, and this new budget tells us who is paying for it: 2 million British taxpayers, who will pay an additional £26 billion. These massive tax and spending increases have led to slashed growth forecasts. Taxes as a share of GDP are now forecast to reach an all-time high of over 38% by 2029-30.

The Office for Budget Responsibility (OBR) accidentally leaked the economic fallout before Reeves even made her announcement. They predicted that "Real GDP is forecast to grow by 1.5% on average over the forecast, 0.3% slower than we projected in March, due to lower underlying productivity growth".

They expect inflation to reach 3.5% in 2026 - slightly higher than the forecaster estimated in March when it predicted a 3.2%. It also lifted next year's forecast from 2.1% to 2.5%. The OBR maintains its 2% estimate for 2027 and the following two years.

Major Changes to the Budget

The leak confirmed a three-year extension of the freeze on tax thresholds, which are projected to raise £14.9 billion. This will pull more earners into higher tax brackets.

Other tax changes will raise a further £11 billion by 2029-30, including:

-

A new mileage-based charge on electric and plug-in hybrid cars from April 2028 (raising £1.4 billion)

-

A reduction in writing down allowances in corporation tax (£1.5 billion)

-

Reforms to gambling taxation (£1.1 billion)

-

Changes to capital gains tax reliefs on employee ownership trusts (£0.9 billion)

-

New tax administration, compliance, and debt collection measures (£2.3 billion).

-

An annual charge of £2,500 on homes worth over £2m, and £7,500 on homes over £5m.

*****

The autumn 2025 budget was generally poorly received, especially for its high taxes and lack of long-term growth strategies. The Resolution Foundation estimates that this parliament will be the second-worst on record for income growth.

Plaid Cymru described it as a "bad Budget in every way", and the Democratic Unionist Party of Northern Ireland labelled it an "unfair Budget" that relies too heavily on taxing working people. Experts agree that the budget fails to adequately address the cost-of-living crisis.

Welcome news includes spending increases on welfare and the National Living Wage rising to £12.71/hr from April 2026. Cuts to winter fuel payments and disability benefits have also been reversed, as well as the two-child limit on benefits. Reeves also introduced a much-needed one-year freeze on spiralling rail fares and prescription charges. State pensions were increased by 4.8%, and the student loan repayment threshold was also frozen.

Businesses welcomed the new £725 million Growth and Skills Levy, and £120 billion in capital investment has been committed to infrastructure, transport, and energy. Reeves is beginning to address the under-taxation of high-value homes and the balance of taxation between "earned" and "unearned" income with a new 2% levy.

The UK is experiencing a prolonged period of subdued productivity, inflation, and tight fiscal conditions. The continued pressure on household finances is reflected in public opinion of the lacklustre Labour government. As of early 2026, ratings of Prime Minister Keir Starmer have reached historic lows. Three-quarters of Britons now view Starmer unfavourably, notably due to his poor performance on major issues such as immigration, housing, and cost of living.

Author: Rachael Mellor, 18.02.26 licensed under CC BY-SA 4.0

For further reading on the UK Budget see below ⬇️

- Guardian - Budget 2025 503659

- Guardian - Budget 503651

- Guardian - Budget Deficit 503654

- Stamp Out Poverty (UK) 503657

- The most misleading thing about Rachel Reeves’s budget? Who it was really for - Guardian 02.12.25 503662

- This was Rachel Reeves’s ‘live now, pay later’ budget. The big question is: what happens when ‘later’ arrives? - Guardian 27.11.25 503655

- Budget 2025: key points at a glance - Guradian 26.11.25 503652

- Could you do better than Reeves as chancellor? Play our interactive budget game - Guardian 20.11.25 503653

- The Guardian view on the budget: what a Labour chancellor should really say - Guardian 26.10.25 503656

- Rachel Reeves is the face of this budget. But the really big decisions are not in Labour’s hands - Guardian 23.10.25 503658

- Thatcher-style tax on bank windfalls could raise billions for public services, says IPPR 29.08.25 503661

- Budget of the United Kingdom - Wikipedia 503647

- Government spending in the United Kingdom - Wikipedia 503648

- United Kingdom national debt - Wikipedia 503649

- 2023 United Kingdom budget - Grokipedia 503650

- YouGov - Voting Intention 503660